Then u thought wrong.

Doubt it. I just gave up talking about it.

Nondiscretionary vs. Discretionary

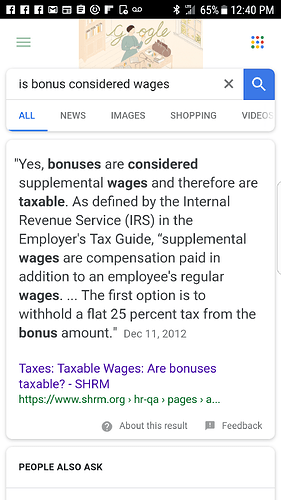

Under the federal Fair Labor Standards Act (FLSA), bonus payments are divided into discretionary and nondiscretionary types. Only nondiscretionary bonuses, incentive payments, and commissions may count toward as much as 10% of the salary threshold beginning in December 2016.

Bonuses are discretionary if:

Both the fact that payment is to be made and the amount of the payment are determined at the sole discretion of the employer; andThe bonuses are not paid under any prior contract, agreement, or promise causing the employee to expect such payments regularly.

Bonuses are nondiscretionary if the employer promises, contracts, or agrees to pay a bonus to the employee.

Nondiscretionary bonuses include:

Bonuses that are promised to employees upon hiring.Bonuses that are the result of collective bargaining.Bonuses that are announced to employees to induce them to work more steadily, more rapidly, or more efficiently.Attendance bonuses.Individual or group production bonuses.Bonuses for quality and accuracy of work.Bonuses that are announced to employees to induce them to remain with the firm.Bonuses contingent upon the employee’s continuing in employment until the time the payment is to be made.

Not my country but this is straight from the FLSA.

So yes, as to my original post before this, he COULD refrain from making a bonus “agreement” and verbally tell his employees the better they do, the better the chance of a receiving a bonus…

And he isn’t arguing that’s it’s not a wage. It’s supplementary. My wage is a set amount with an 80 cent increase every year. Anything is extra wages but still a bonus.

Which has nothing to do with him avoiding a bonus agreement and deducting what ever amount he wants due to tool breakage or anything else.

No, it isn’t. It’s a TAXABLE compensation, but it is NOT guaranteed. Unless you clearly have a contract that makes it part of your compensation package (non negotiable, guaranteed pay) .

MANY companies, both large and small, use a bonus for their employees. Unless you have a contract, you can’t force the employer to pay a bonus if they don’t want to. It’s an extra perk, if the employer so chooses.

Several manufacturing companies use the bonus as a way to reduce costs.

Why you are going off on a tirade about it having to be guaranteed, is beyond me. It just isn’t. It’s something extra, a NICE gesture, that’s all, nothing more.

I never said it was guranteed. Not sure wjy u think i said that. Of course its not guranteed.

Because you are arguing that an employer CAN’T reduce a bonus based on employees breaking tools, or deducting any other expense, they see fit, out of a bonus they feel like paying.

Lol. Getting lost in your own argument now?

Oh ok. Glad u know it all.

Well he does realize what the conversation was about. Lol.

Wowzers! I wasn’t expecting such a frisky conversation. I’m glad you guys seem to have worked out my problem.  It makes it easier for me.

It makes it easier for me.

So the only slightly little problem was that I’m writing up an agreement because of all of my parents very poor experiences of unmet expectations in business dealings, it’s making me want to lean the other way to having stuff documented. Also this employee has had employers jip him, and communication seems to be our biggest hang ups. So if it’s all in paper, I figured it’d be less likely for either party to get their panities in a knott from less than clearly articulated expectations of what will keep from this full bonus being paid out. Unfortunately it looks to be MUCH more of a legal head ache.

Nonetheless I really appreciate all of your guys opinions/arguments for why you believe what you do. It’s definitely helping point me in the right direction, and I’m sure it’ll help future readers wondering the same thing.

@RSH Would you by chance be willing to share the section in your employee handbook about bonus to gather some ideas on formal structure?

Also I forgot to mention that this was a bonus I told him at the end of the year I’d give him if he came back and started a specific time, the only caveat being if there was negligence, It’d come out of the bonus… I’ll have to go back and figure this one out.

Our bonus is performance based.

Finish your route by the end of the month and earn 5% of that months’ route’s value.

Maintain less than 2% cancellations by the end of the month then earn a bonus of 5% of that months’ route’s value.

We do not give bonuses for attendance or punctuality as that is just expected.

We also have prehire agreements for damages. It’s something like this:

Any damages to company property or customer property due to negligence of the employee will be deducted from employee’s normal method of pay up to $500 per occurrence which may be divided by and deducted over no more than 4 pay periods.

Then the employee signs under that. Then if sonething does happen we have an accident form that is numbered that the employee must fill out and give details. An appraisal for damages is attached (or reciepts). Then another form that authorizes the deductions references that accident form has the break down per check for deductions:

(Blank space) agrees to have (amount owed) deducted from their payroll on the following paydates. (Then dates with amounts is filled in)

So to recap for damages:

- Pre hire agreement with limit

- Accident form

- Payroll deduction agreement

See above

"Whether or not employers can charge you for mistakes depends on where you live. The only federal rule is that deductions can’t reduce your pay below minimum wage. This rule applies regardless of what state you live in. But many states provide extra protection for employees who make mistakes.

Most states classify “mistakes” as 1) cash or cash register shortages, 2) acceptance of bad checks, or 3) lost, damaged, or broken equipment. The exact rules on what your employer can do if you make such a mistake vary by state, but one of the most common rules is that your employer needs your written consent to deduct from your pay.

As always, if you have specific questions, contact a business attorney or an employment attorney."

It’s not ALWAYS legal, even with a written agreement, for an employer to deduct “damages” from your check.

1 This is a good reason to talk to a local attorney.

2 An even better reason NOT to have a written agreement about the bonus situation.

Good point @anon82274079, just because a company adds a policy with an emoloyee signature, it doesnt mean much if a state, federal law states different.

The bonuse that I give are purely discretionary. Sometimes they are monetary, in which case my online payroll company, Sure Payroll, deducts the appropriate amount of taxes. Sometimes they are gifts, such as holiday turkeys or hams, a vacuum, bike, a Minnesota Fighting Saints shirt, a board game, etc.

Reading this thread makes me realize that I should update my Employee Handbook to say that bonuses are discretionary.