Ok so only a few months out from 2019 and that will close my first year as a business owner. I have no clue what to do or how to handle taxes. I just have been saving 30% from every deposit I have made. But idk how to prove my income from the business. It hasn’t been much. 5k or less hope you guys have some info that don’t consist of paying 100$ a month for some system

If you use quickbooks, or a similar accounting software, you print your documents. When I do taxes, it line items all my income, and all my expenses.

You are going to need something to keep track of everything. Otherwise, whoever is going to do your taxes, is going to strangle you.

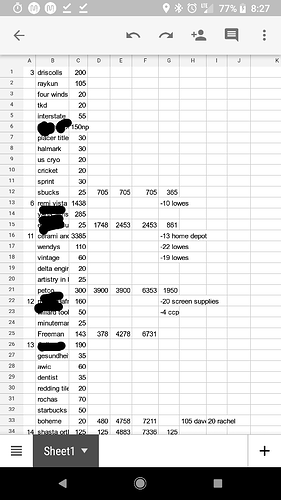

we use google sheets. i open a new sheet for every month. i enter the date, the job, the total, the daily total, weekly and monthly. the last column is my partners pay and his half of expenses. i add all the months up at tje end of the year for our total. i have a seperate spreadsheet for expenses. every time we buy something i take a picture of the receipt for our records and then put it in the spreadsheet with date, store, and dollar amount.

Depends on if you are a S Corp or LLC. Do’t forget in Ohio you have sales tax to report for every county monthly or quarterly you did work in, so separate routes so you can grab sales in any county. Used to be in CMH.

Plenty of apps or programs to record sales/expenses. you HAVE to know whats coming in against whats going out, that includes income for you, the owner/operator.

Wave accounting is a good program to look at, otherwise use an accountant for end of year. They’ll know how to get you the rght figures - as was stated by hoosier tho, you have to provide the numbers to start with, especially at end of year.

I am from OH and use the “Ohio Business Gateway” along with Quickbooks.

John